Introduction to Kaufman Adaptive Moving Average (KAMA):

Developed by Perry J. Kaufman, KAMA is an adaptive moving average that adjusts its sensitivity based on market conditions, designed to address market noise and volatility. During periods of minimal price swings and low noise, KAMA stays close to the price movements. However, when price swings become more wider, KAMA flexibly adjusts and maintains a greater distance from the prices. You can clearly see this by compairing KAMA with the SMA (Closely follows the price all the time)

In this article, we’ll explore the concept of KAMA, its calculation, and how it can be used to enhance your trading strategies.

How the Kaufman Adaptive Moving Average (KAMA) is Calculated: Understanding the Formula:

The KAMA calculation involves three essential components: Efficiency Ratio (ER), Smoothing Constant (SC), and the current price. Here’s how it is calculated:

- Efficiency Ratio (ER):The Efficiency Ratio measures the relative efficiency of price movements. It is computed as the ratio of the absolute difference between the current price and the price

nperiods ago to the sum of the absolute differences between each price and its previous price overnperiods.Efficiency Ratio (ER) = |Close – Close (n periods ago)| / Σ |Close – Close (1 period ago)|, where ‘n’ is a parameter set by the trader. - Smoothing Constant (SC):The Smoothing Constant determines how quickly KAMA adapts to changes in price volatility. It is calculated using the following formula:Smoothing Constant (SC) = [ER * (fastest SC – slowest SC) + slowest SC]^2The ‘fastest SC’ and ‘slowest SC’ represent the upper and lower bounds of the smoothing constant, often set to 2 and 30, respectively.

- Kaufman Adaptive Moving Average (KAMA):The KAMA is then calculated by applying the smoothing constant to the previous KAMA value, along with the current price and previous KAMA value:KAMA = Previous KAMA + SC * (Price – Previous KAMA)

Advantages of Using Kaufman Adaptive Moving Average (KAMA):

- Adaptability to Market Conditions: The most significant advantage of Kaufman Adaptive Moving Average is its ability to adapt to different market conditions. During trending markets, KAMA tracks the price closely, providing timely signals. In choppy or sideways markets, KAMA responds less sensitively, reducing the risk of false signals.

- Smoothness: KAMA reduces noise and produces a smoother line compared to other moving averages. This makes it easier for traders to identify the underlying trend with greater clarity.

- Reduced Lag: KAMA significantly reduces lag compared to traditional moving averages. As a result, traders can respond faster to changes in price trends.

- Suitability for Crossovers: KAMA crossovers with price or other moving averages can indicate potential entry or exit points. The adaptive nature of KAMA ensures that crossovers are more reliable and meaningful.

Trading Strategies with Kaufman Adaptive Moving Average (KAMA):

- Identifying the Trend:When the price is above the KAMA, it typically indicates an uptrend, suggesting a potential opportunity for entering a long position. On the other hand, when the price is below the KAMA during downtrends, it signals a potential chance to enter short positions.

- Generating Entry and Exit Signals:Combining KAMA with other indicators like SMA or EMA can provide valuable entry and exit signals in trading strategies. Since KAMA tends to react more slowly to trend changes, using a crossover strategy with SMA or EMA can offer indications of potential buying and selling opportunities.When the SMA or EMA crosses above the KAMA, it could be seen as a buy signal, indicating a possible uptrend. Conversely, when the SMA or EMA crosses below the KAMA, it may be considered a sell signal, suggesting a potential downtrend.

Incorporating KAMA into Your Trading Strategy:

Integrating KAMA into your trading strategy requires a thoughtful approach. Consider the following tips:

- Confirmation with Other Indicators: Always confirm KAMA signals with other technical indicators, such as RSI, MACD, or Bollinger Bands, to strengthen your trading decisions.

- Parameter Optimization: Experiment with different values of ‘n’ and the smoothing constants to find the best fit for the assets and timeframes you are trading.

- Risk Management: No indicator can guarantee profits. Implement proper risk management techniques, including stop-loss orders, to protect your capital.

- Backtesting: Before using Kaufman Adaptive Moving Average in live trading, backtest it on historical data to assess its performance and effectiveness with your chosen assets.

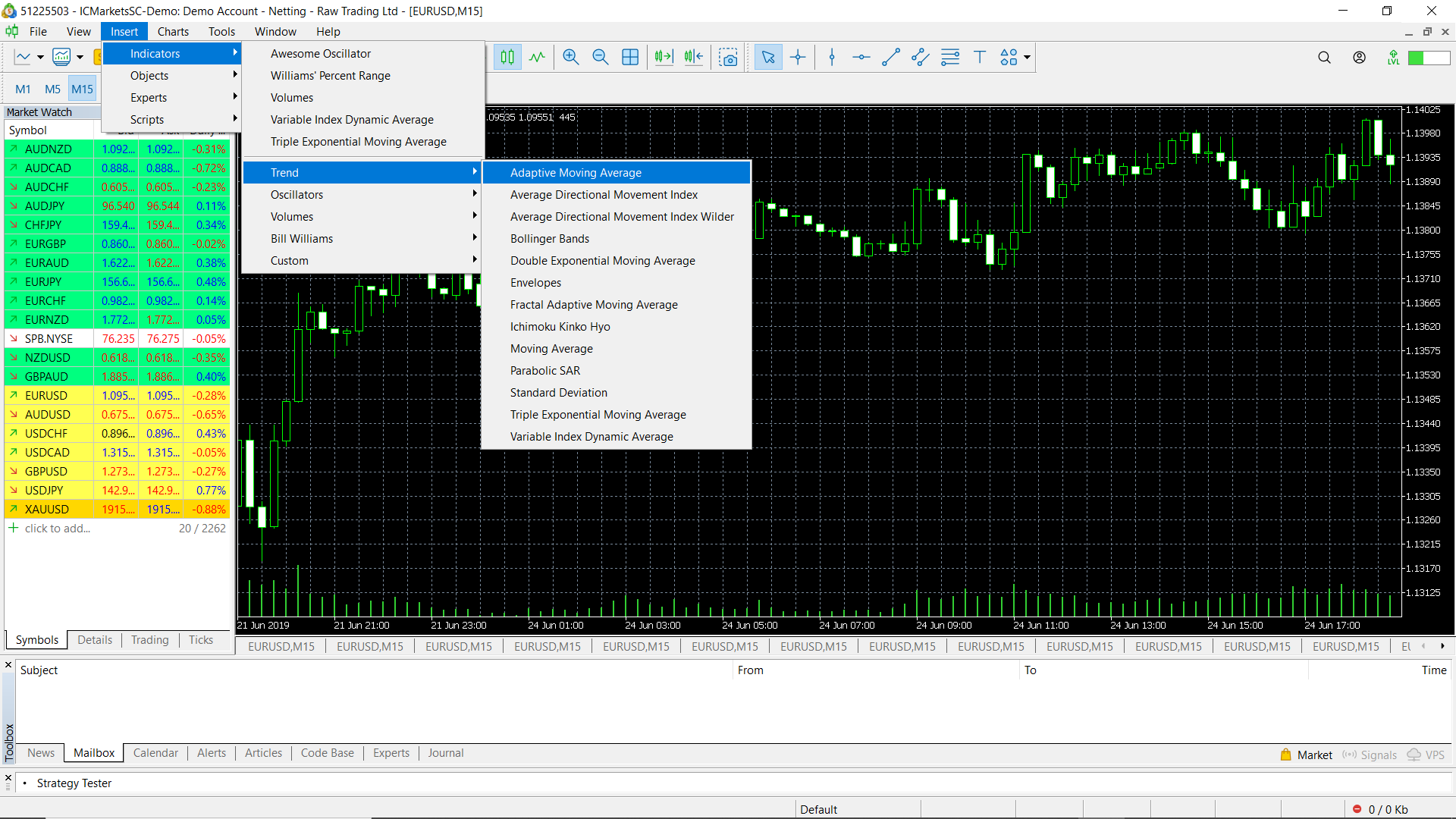

Using Kaufman Adaptive Moving Average (KAMA) with MetaTrader 5 (MT5):

Open Meta Trader. Then Insert > Indicators > Trend > Adaptive Moving Average

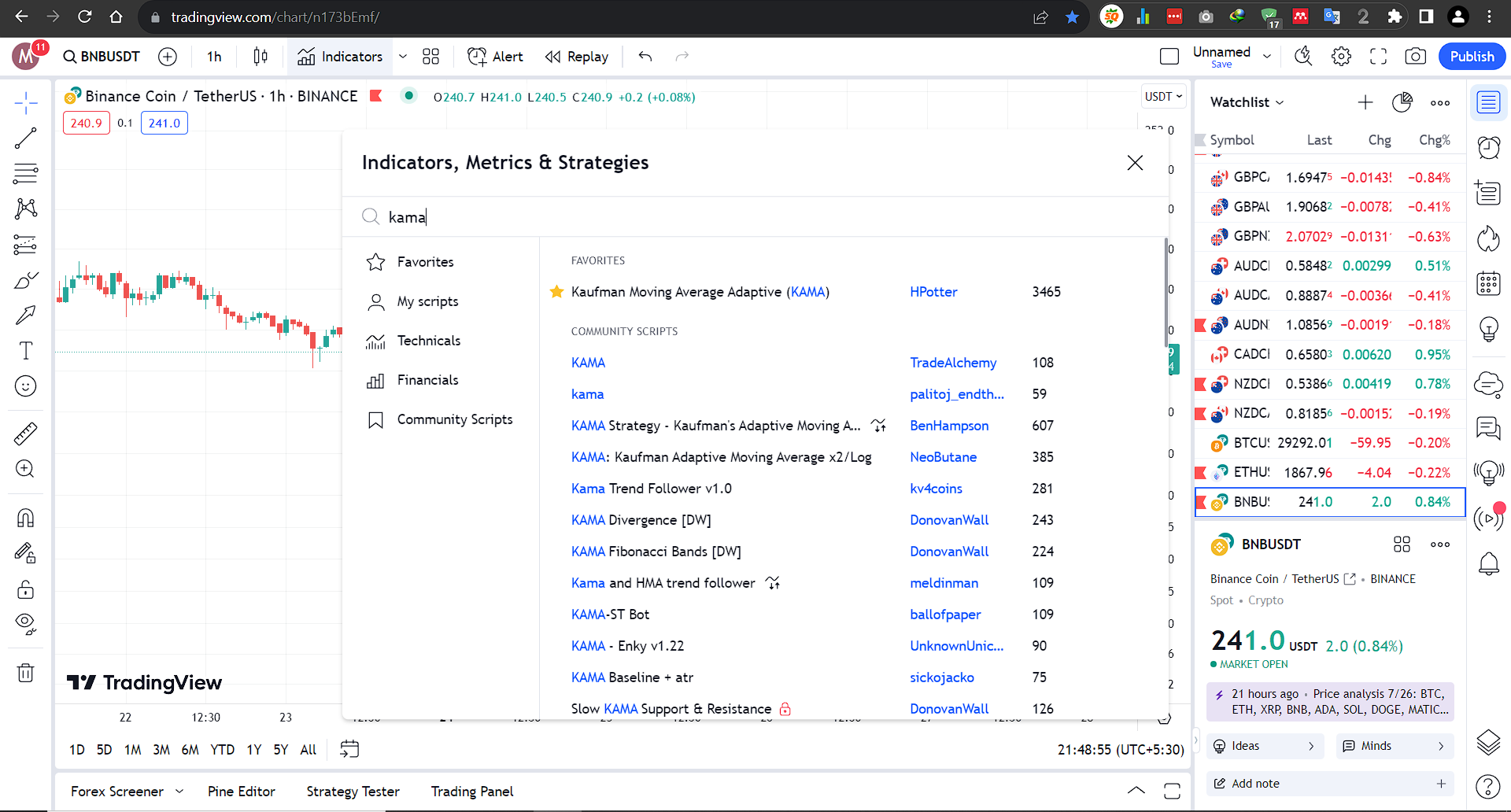

Using Kaufman Adaptive Moving Average (KAMA) with Tradingview:

Goto Indicators, then search for “‘kama”. Click on the name of indicator to insert it into chart

Conclusion

The Kaufman Adaptive Moving Average (KAMA) is a dynamic indicator that can improve your trading strategy. Its adaptability to changing market conditions, decreased latency, and improved performance make it a valuable tool for both novice and seasoned traders. As with any indicator, KAMA is most effective when combined with other instruments and confirmed by technical analysis. By mastering the art of KAMA, you can increase your trading success by gaining a deeper understanding of price trends.

Explore Our Algorithmic Trading Courses:

Cryptocurrency Investing with Python | Earn Passive Income !

Code your own Bot with Python to Automate Crypto Investing in Binance. Upload Him to a Server and He Will Do the Rest !

4.9 Rating

2.5 Hours

1.5K+

$119.99

$13.99

Binance Futures Trading with Python | Build a Market Maker Bot

Unlock the power of automated trading with Binance Futures and Python. Maximize profits with tech & expertise in trading

4.9 Rating

2.5 Hours

1.2K+

$119.99

$13.99

Forex Algorithmic Trading with Python : Build a Grid Bot

Create your own profitable Grid Bot with Python. He can trade many currency pairs at once. With free Bot included !!

4.9 Rating

3 Hours

1.5K+

$119.99

$13.99

Master Forex News Trading with Python | The Secret Strategy

Build an Automated Trading Bot to Capture the Volatility of News Events-with Semi Intelligent Take Profit and Stop Loss

4.9 Rating

2.5 Hours

1.2K+

$119.99

$13.99

Binance Futures Trading with Python | Build a Martingale Bot

Stop wasting time on Paid trading Bots – Create your own Binance Futures Bot and take control of your trading strategy !

4.9 Rating

2.5 Hours

1.5K+

$119.99

$13.99

The Complete Foundation Binance Algorithmic Trading Course

Binance Algorithmic Trading from A-Z | Spot and Futures trading, Build Strategies, Automate with Cloud Server + More

4.9 Rating

4 Hours

1.5K+

$119.99

$13.99

Forex Algorithmic Trading with Python : Build a DCA Bot

Create your own profitable DCA Bot with Python. He can trade many currency pairs at once. With free Bot included !!

4.9 Rating

3 Hours

1.5K+

$119.99

$13.99

The Ultimate Forex Algorithmic Trading Course | Build 5 Bots

Build your own SMA Crossover Bot, Bollinger Bands Trading Bot , Grid Bot, DCA Bot and a Basic Bot to learn Fundamentals

4.9 Rating

4 Hours

1.5K+